Industry research

Scope

Europe

Companies

59

Table of contents

Report collaborator:

Konstantin Kugler, Partner Transaction Advisory & Strategy, and Christian Riede, VP Technology & AI Strategy at OMMAX, provided expert insights for this report. Read the full interview here

What does the low-code & no-code platforms market landscape look like in Europe?

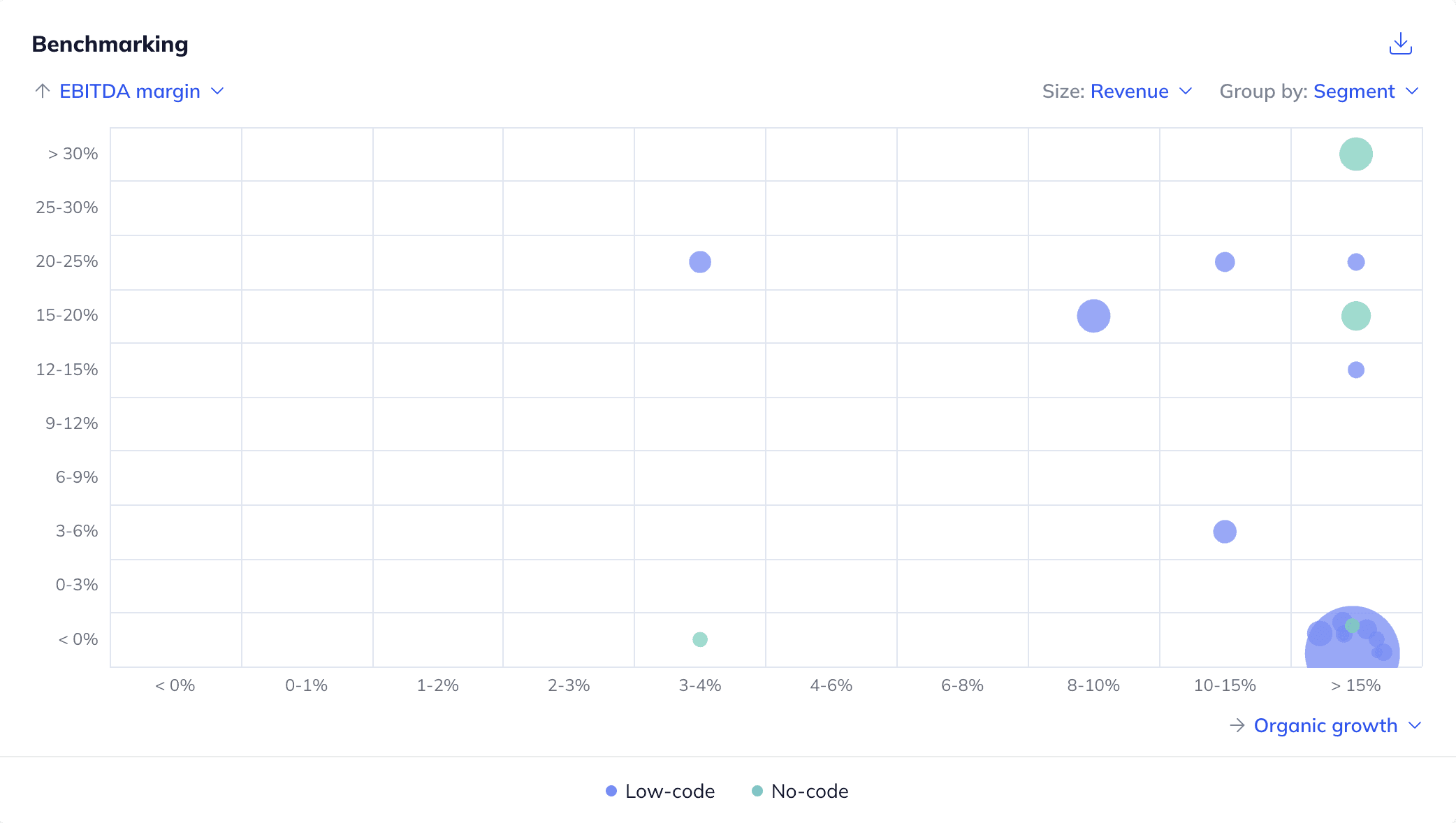

The European LCNC market remains fairly fragmented, with various generalists and large players dominating general applications (e.g. finance, HR), complemented by a long tail of smaller businesses pursuing specialist propositions (interviews by Gain.pro). As such, identified players seek to differentiate themselves through domain expertise, integration capabilities and technological innovation (e.g. AI). Low-code platforms tend to see greater adoption among larger customers and are sold through longer, more complex sales cycles, whereas no-code platforms are typically deployed at a smaller scale, feature shorter sales processes and demonstrate higher churn due to lower switching costs. While AI and no-code platforms increasingly automate customer processes, demand for low-code platforms is expected to persist, as more complex use cases require tailored integrations and ongoing maintenance that cannot be fully addressed by no-code tools or AI alone (interviews by Gain.pro; OMMAX expert interview).

What is the level of investor activity in Europe's low-code & no-code platforms industry?

Investor-led interest in the European LCNC platform industry has been significant, with >90% of identified assets being sponsor-backed (December 2025). Investors are primarily attracted by (i) IT talent shortages which can be addressed by LCNC platforms, (ii) AI facilitating value-adding features and greater automation potential, as well as (iii) strong demand for digital transformation projects among European businesses. On the other hand, (i) LCNC platforms’ limited applicability in larger enterprises, (ii) significant security risks as well as (iii) the complexity of LCNC platform integration and maintenance serve as detractors for investors.

What are the key ESG considerations in Europe's low-code & no-code platforms industry?

The ESG agenda of LCNC platforms focuses on social and governance topics. On the social side, LCNC platforms address the global shortage of IT talent, thereby opening the software development process to a larger pool of the (future) workforce and enhancing their technical skills. In terms of governance, LCNC platforms can be used to improve business ESG reporting by rapidly integrating ESG data sources, adapting to evolving regulations as well as ensuring visibility, control and accountability without diverting skilled development personnel from core and complex business challenges.

Industry experts forecast the European LCNC platform market to grow at a ~20% CAGR from 2025-2030 (interviews by Gain.pro)

Technavio (January 2025) estimated the global low-code AI platform market’s value at ~$10.6bn in 2024 and projects it to reach ~$42.9bn by 2029 (+32.2% CAGR)

Organisations are under increasing pressure to deliver digital products efficiently due to a global shortage of IT professionals and rising development costs. LCNC platforms help by speeding up development and reducing reliance on scarce technical talent, as well as cutting staffing and recruitment expenses, thereby increasing demand for identified incumbents (interview by Gain.pro)

LCNC platforms are expected to benefit from the continued advancement of AI through the integration of value-adding features for end-customers. In parallel, intelligent automation and assistive capabilities enhance LCNC platform development and usability, lowering adoption barriers and supporting broader end-user uptake (interview by Gain.pro; Compact.nl, January 2025)

Strong demand for digital transformation projects among European businesses, with LCNC platforms serving as a time- and cost-effective alternative to IT development outsourcing (interview by Gain.pro; CBI, March 2025)

LCNC platforms have limited applicability in larger enterprise segments. Applications with extensive user bases or consumer-facing software often require more customisation and development resources than LCNC’s drag-and-drop approach can provide, therefore curbing demand for identified players (interview by Gain.pro)

Significant security risks can hinder end-user adoption of LCNC platforms. Since applications built by citizen developers often lack proper IT supervision, they are especially vulnerable to security breaches. Ultimately, this could result in significant financial and reputational damage (interview by Gain.pro; KPMG, November 2024)

The complexity and cost of LCNC implementation and maintenance remain major obstacles to the sector's growth. This can lead to performance bottlenecks, delays in updates and higher reliance on external support, limiting platforms’ overall effectiveness (KPMG, November 2024)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 59 private companies, incl. financials, ownership details and more.

A view on all 167 deals in the industry

ESG assessments with highlighted ESG outperformers