Industry research

Scope

Europe

Companies

80

Table of contents

Mairi Fairley (Partner) at OC&C Strategy Consultants, provided expert insights for this report. She has experience in corporate strategy across proposition, pricing, international expansion and operating model improvement in the retail and leisure sectors. Read the full interview here

What does the fashion retail market landscape look like in Europe?

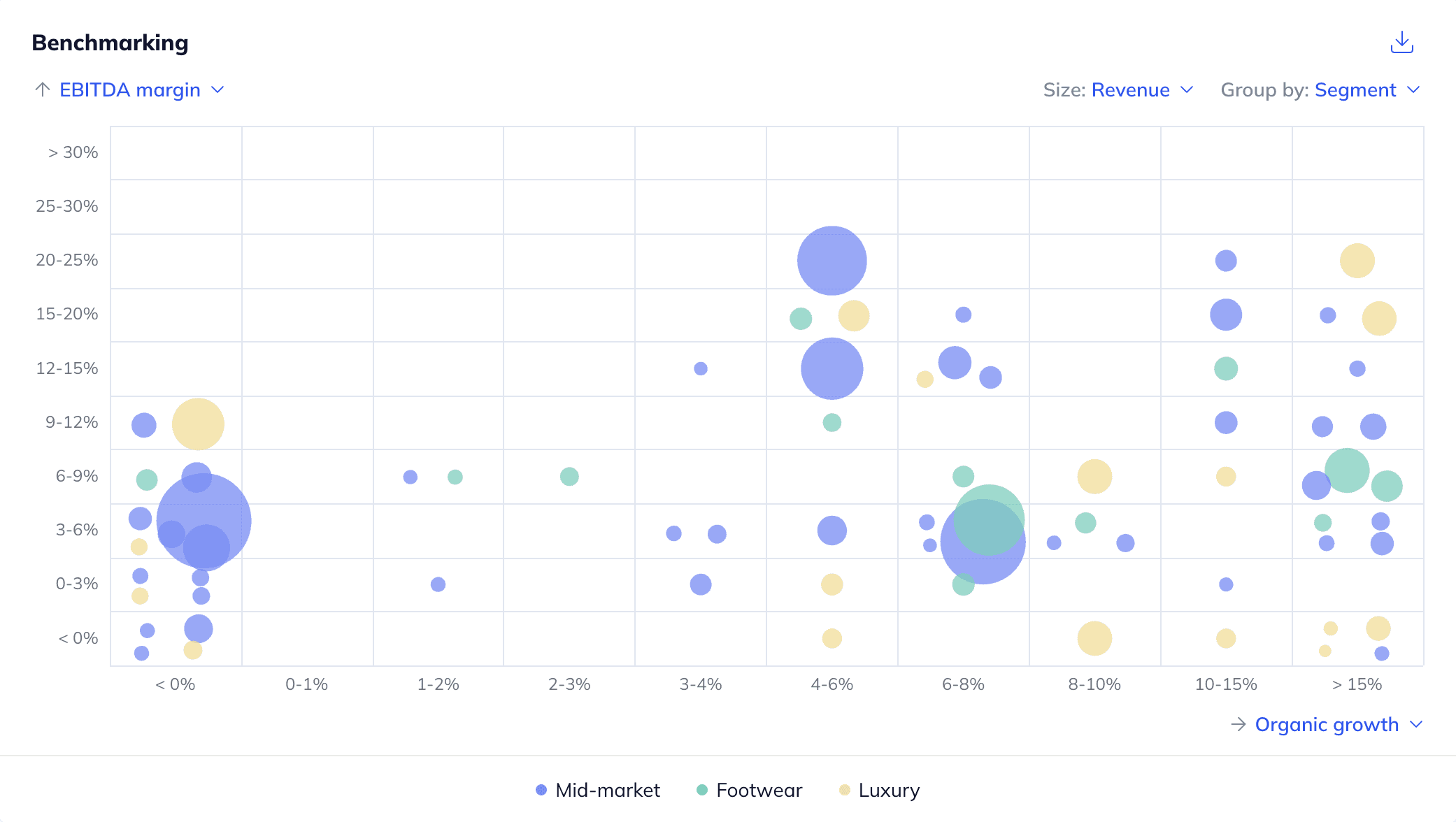

The European market remains relatively fragmented, with fashion retailers facing pressure from retail generalists, fashion brands with growing direct sales, low-cost Asian disruptors (e.g. Shein) and second-hand platforms. Herein, fashion demand is polarising toward value-for-money options on one end and high-quality premium clothing on the other, leaving mid-market players fighting for a shrinking market (OC&C expert interview). Furthermore, the growing consumer adoption of online shopping has prompted retailers to pursue a multichannel model (e.g. webstore, brick-and-mortar), although this often entails higher customer acquisition costs, weaker repeat purchasing and intensified price competition. To differentiate themselves, incumbents focus on niche positioning, personalised offerings and targeted marketing to strengthen customer loyalty.

What is the level of investor activity in Europe's fashion retail industry?

Investor-led interest in the European fashion retail industry has been modest, with ~30% of identified assets being sponsor-backed (November 2025). Investors are primarily attracted by (i) the broad availability of customer data for targeted marketing and product suggestion purposes, (ii) growing demand for speciality and higher-quality fashion with greater upside potential and (iii) opportunities for incumbents to expand into adjacent product offerings (e.g. homeware). On the other hand, (i) the rise of second-hand platforms and fast-growing Asian disruptors, (ii) more demanding sustainability standards and regulations and (iii) the persistent cost-of-living crisis that tightens consumer budgets and boosts bargain-hunting serve as detractors for investors.

What are the key ESG considerations in Europe's fashion retail industry?

ESG considerations in the European fashion retail industry encompass environmental and social matters. The primary environmental issues stem from the greenhouse gas emissions associated with producing and transporting fashion products as well as the waste of energy and clothing generated throughout the retailing process. To address this, incumbents implement targeted sustainability measures to reduce emissions across the value chain and incorporate energy efficiency and circularity into their daily operations. From a social perspective, the appropriate treatment of customer data remains a top priority for identified players. To ensure this, incumbents reinforce their safeguards by deploying more advanced authentication systems and substantially enhancing their cybersecurity efforts.

The global online apparel retailing market is expected to grow from ~$308.3bn in 2024 to ~$651.5bn in 2029 (+16.2% CAGR 2024-2029; Technavio, May 2025)

The global online apparel retailing market is expected to grow from ~$308.3bn in 2024 to ~$651.5bn in 2029 (+16.2% CAGR 2024-2029; Technavio, May 2025)

The broad availability of customer data enables more precise targeting of promotions and product suggestions, aligning them closely with individual preferences. Combined with consumers’ growing comfort with online purchasing, this higher-accuracy marketing is expected to lift average basket sizes (McKinsey & Company, January 2025; BCG, November 2024)

Growing demand for speciality, higher-priced and high-quality fashion supports premium segment expansion. This enables retailers to lift margins through premium assortments, limited-edition collections and designer collaborations, reducing reliance on volume- or price-led competition (OC&C expert interview; McKinsey & Company, November 2024)

Stable demand for clothing and footwear is combined with growth opportunities for fashion retailers in adjacent categories. Evolving consumer preferences allow retailers to broaden their assortments beyond traditional apparel (e.g. homeware, lifestyle products), creating additional revenue streams and a broader addressable market for incumbents (Retail Sector, June 2025)

The rise of second-hand platforms (e.g. Vinted) affects the market for new apparel, putting pressure on volume and margins for traditional European fashion retailers. At the same time, fast-growing Asian disruptors (e.g. Shein) intensify competition with ultra-low-cost offerings backed by globally optimised supply chains (OC&C expert interview; BCG, October 2025)

More demanding sustainability standards will further squeeze margins for identified players. Growing pressure from consumers and regulators raises the cost of cleaner logistics and shipping while offering limited upside potential (interview by Gain.pro; European Commission, September 2024)

The persisting cost-of-living crisis reduces discretionary spending and fuels greater bargain-hunting and heightened sensitivity to promotions. Ongoing developments in technology (e.g. GenAI) further accelerate this trend by enabling rapid deal discovery and effortless price comparisons (Eurofound, May 2025; BCG, November 2024; BCG, October 2024)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 80 private companies, incl. financials, ownership details and more.

A view on all 369 deals in the industry

ESG assessments with highlighted ESG outperformers